ESG pushback within the United States is affecting business matters in a substantial way. In January, a Texas federal judge ruled that American Airlines was in violation of federal law after the airline invested 401(k) plans with asset managers favoring ESG initiatives over financial benefit. The court concluded that American Airlines breached its fiduciary duty, and it is safe to assume that other ESG-friendly firms will soon face similar lawsuits for any poor performance associated with ESG investing.

ESG isn’t the only acronym losing its elevated status in corporate America; DEI programs are also facing a watershed moment. President Trump’s Executive Order 14171, titled Ending Illegal Discrimination and Restoring Merit-Based Opportunity, emphasizes that “individual merit, aptitude, hard work, and determination” and not “how people were born” should determine whether or not someone is hired. Trump’s EO on DEI could have been done in his first term, so its emergence now is notable, and reinforces the notion that politics is downstream from culture. Indeed, a vibe shift has seemingly occurred in the marketplace and therefore what government mandates (or backs away from) is also evolving.

Even at the World Economic Forum in Davos, it’s been reported that ESG and DEI talk is diffused, thanks in part to AI matters stealing the spotlight and Trump’s reelection ruffling the feathers of Europe’s elite class. Anti-woke advocates, however, shouldn’t assume that the business environment will dramatically transform in the coming years. ESG and DEI are an embedded part of how some industries now operate. In fact, before ESG talks gained real traction in the early 2000s or the “racial reckoning” eruption of 2020, firms were already vested in matters connected to both these realms. Moreover, the priority that has been placed on studies related to sustainability and workplace diversity in business education programs has pre-programmed those who are now in managerial and C-suite positions to champion for stakeholder concerns rather than shareholder returns.

So, with this in mind, and given that there are several worthwhile articles already available which trace the history (along with the merits and demerits) of ESG and DEI, it might be worth looking at this matter through a different lens. And a business school concept, with its own catchy acronym, may be what’s needed to provide a more nuanced point of view regarding the supposed decline of ESG and DEI.

Applying the PLC

Product Life Cycle theory, referred to as the PLC, is often taught to business students to convey the limits of commercialization and how strategies related to distribution, communication, and pricing will inevitably need to change over time. The PLC concept originated in a 1950 Harvard Business Review article titled “Pricing Policies for New Products,” however, it wasn’t until the publication of Theodore Levitt’s Exploit the Product Life Cycle (1965) that the PLC gained true notoriety.

The application of the PLC has expanded over time to encompass more than just a focus on products and sales, and insight derived from dominant marketing theorists such as Raymond Vernon (1966), William Cox Jr. (1967), and Michael Porter (1980) have advanced the understanding of the PLC framework.

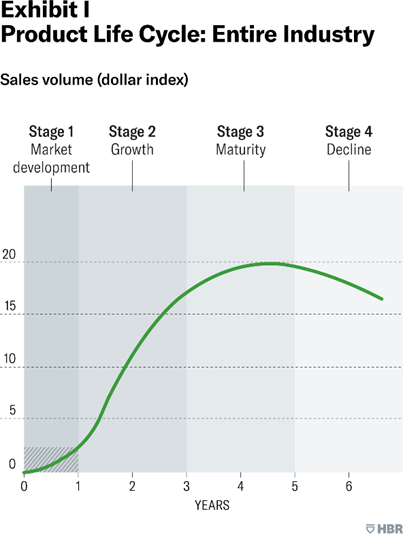

Essentially, the PLC posits that new products follow an S-shaped curve in relation to four stages: market development, growth, maturity, and decline. And this model can also be applied to the adoption process of new services, new ideas, and new programs (like ESG and DEI) within a marketplace.

According to the PLC, a product’s ‘life’ stage changes in accordance with perceived value and market demand, and the ‘newness’ level of a product will impact how it is marketed over time. By conceptualizing the PLC, firms can engage in proactive decision-making regarding their marketing strategies. During the first stage, known as ‘market development,’ focus is placed on generating awareness of and interest for what is being offered. But, when an influx in sales is assured, and competition from new entrants arises, promotional strategies shift from focusing on the product itself to leveraging branding mechanisms and differentiation tactics. ‘Why buy’ becomes ‘why buy from me.’

ESG and DEI have had a long and storied history regarding market development, but the establishment of formalized standards, policies, and rating systems, along with the attraction for practitioners and education programs represents the evolution of ESG and DEI and their growth trajectory.

The duration of the ‘growth’ stage, as well as the next stage of the PLC, ‘maturity,’ largely depends on the interests of the market and the level of brand equity an organization has acquired. Similar or substitute products are typically readily available during the maturity phase, so marketing tactics tend to focus on reinforcing the value proposition of what is being offered. Depending on market interests and technological advancements, the maturity stage can move quickly, like it did for Discman, or slowly like it has for dishwashers (due in part to the sluggish impact of regulatory compliance), which is why marketers must always be vigilant and prepared.

Defying the PLC

The final stage of the PLC, ‘decline,’ occurs when the interests of consumers and/or the resources of producers are largely redirected to new offerings. And, to some extent, this is what we are witnessing with ESG and DEI today. Businesses are going back to the basics in how they allocate their resources and organize operations. It is important to note, however, that what has been started is unlikely to go away completely. The Discman may be a thing of the past, but the portable music industry lives on in various forms. And what an industry previously invested its efforts in is unlikely to be fully put to bed as a sunk cost, even when standards and expectations change.

Sometimes, in fact, a resurgence can be rather profitable. The market is volatile and often unpredictable; CD players may someday trend again just like record players are today. The vinyl revival is one that few saw coming and, therefore, offers an important lesson. The PLC is not perfect, and the decline stage is not definite. Firms can sometimes resurface that which has fallen out of favor by means of repackaging or repositioning. And new consumer bases and younger generations can be rather receptive to things from the past — and not just in relation to products (socialism’s appeal amongst America’s youth has been a concerning matter for quite some time).

Marketing campaigns promoting social justice may be dwindling, and managerial practices related to DEI training may seem to be shrinking, but ESG and DEI will never truly be obsolete. DEI is already being repositioned with a focus on inclusion and belonging, downplaying the emphasis on diversity and equity, and this form of rebranding will make it even more difficult to argue against. Programs and activities promoting engagement and ‘community building’ will be featured to a greater degree and Chief Diversity Officers will be reclassified as Chief Belonging Officers or Chief Engagement Officers. DEI Offices will be renamed to titles like ‘Office of Inclusion,’ or will be merged with programs related to outreach and service initiatives, or multicultural engagement and education.

As for ESG ratings already baked into financial risk assessments and adopted as industry metrics for best practices, such standards will remain in some form or other. In August 2023, the Wharton School of the University of Pennsylvania featured commentary titled “ESG: Changing the Conversation, Maintaining the Message,” and conveyed that although BlackRock CEO Larry Fink has shied away from using the term ESG, it didn’t mean his firm was backing off “its commitment to include environmental, social, and corporate governance (ESG) issues in its investment decisions.”

Recently, BlackRock has withdrawn from the Net Zero Asset Managers initiative (NAZM) which may signal that its commitment is waning as Wall Street aims to lower its environmental activism overall, but it doesn’t mean a complete about-face. BlackRock has reiterated its plan to “continue to assess material climate-related risks.” And such news is likely of great interest to Wharton grads who are partaking in ESG coursework. UPenn recently launched two majors for its MBA program, SOGO: Social and Governance Factors for Business and ESGB: Environmental, Social and Governance Factors for Business, plus an undergraduate concentration focusing on ESG. UPenn is just one of several elite institutions, both within the US and abroad, featuring degree programs which promote ESG, global sustainability, and corporate social performance.

Without a doubt, ESG practitioners and DEI proponents will aim to preserve any positions of power they have attained by means of education and experience — and for that they can’t be blamed. The incentives for such programs were strong and so even if the acronyms go away, the interest levels of select individuals and organizations are likely to stay. Yes, the pendulum for ESG and DEI has swung, but not all the way. It would be wise to remember that today’s decline can become tomorrow’s trend if situations and circumstances along with market interest shift once again.