Electricity prices have moved from the background of daily life to the front lines of politics. What was once a quiet household expense is now a visible burden and a potent symbol of policy failure. Prices are rising not because of corporate greed or runaway markets, but because regulation, politically directed investment, and top-down energy planning have collided with the explosive growth of artificial intelligence. Inflation, supply constraints, and government mandates have turned the grid — once a model of steady reliability — into an arena where economics, technology, and politics now clash.

Americans once fixated on the price of eggs as the emblem of inflation. Now, the new shock comes in electricity bills. Power charges have jumped roughly 4.5 percent in the past year — nearly double the broader Consumer Price Index (CPI) — driven by surging demand from AI data centers and advanced manufacturing against a backdrop of limited supply. “When you have increased demand and limited supply, you’re going to pay more,” said Calvin Butler, CEO of Exelon Corp., which recently set aside $50 million to help low-income customers pay summer bills. The impact is spreading across the largest US grid, PJM Interconnection, where watchdogs estimate data-center growth alone has added $9.3 billion in power costs.

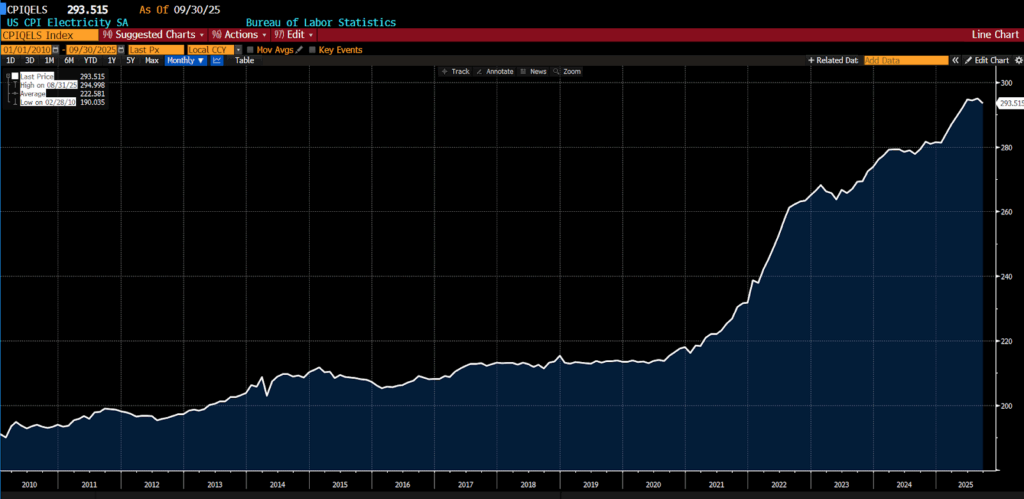

CPI Electricity SA, 2010 – present

(Source: Bloomberg Finance, LP)

The numbers confirm the squeeze. The Energy Information Administration reports that average US retail electricity prices in 2025 are about 13 percent higher than in 2022, with the typical household bill reaching $178 per month. In Virginia — home to the world’s densest cluster of data centers — residential power and transmission costs are expected to rise as much as 26 percent this decade and 41 percent in the next. Wholesale power in regions with aggressive climate targets, such as ISO-New England, has tripled since early 2024. The regulations meant to stabilize the transition are now amplifying volatility.

For two decades, data centers were small, fairly nondescript, warehouse-like structures on the landscape. The rise of generative AI has changed that. Training large language models demands vast computing power, transforming modest warehouses into mega-complexes that draw as much electricity as medium-sized cities and consume millions of gallons of water. Their footprint has turned electricity from a technical concern into an election issue.

In Virginia and New Jersey — this year’s gubernatorial battlegrounds — the politics of AI infrastructure have become a proxy for the nation’s energy debate. Virginia Democrat Abigail Spanberger argues that tech firms should pay a “fair share” for the grid upgrades their operations require. Her Republican opponent, Winsome Earle–Sears, blames clean-energy mandates for higher costs and reliability risks. In New Jersey, some proposals have sought to make data-center developers fund grid modernization, while Republican Jack Ciattarelli calls for more facilities and new gas plants to meet demand. Populist anger over rising bills has blurred party lines: even local candidates from both parties are now calling for moratoriums on new data centers.

US Department of Energy Retail Price of Electricity Sold to Residential Consumers, 2015 – present

(Source: Bloomberg Finance, LP)

States like New Jersey are seeing elevated and rising electricity prices after years of policy choices that prioritized offshore wind build-outs while allowing firm baseload and grid capacity to stagnate—most notably the 2018 shutdown of the Oyster Creek nuclear plant—even as demand accelerates. Now, the AI/data-center surge is colliding with those constraints: PJM projects roughly 32 GW of new peak load by 2030—~30 GW from data centers—creating “upward pricing pressure” and resource-adequacy concerns, and recent reporting shows consumers across PJM picking up billions in transmission costs tied to data-center growth. Offshore-wind obligations also carry above-market OREC costs that regulators and consultants note will be passed through to ratepayers, reinforcing price pressure where transmission upgrades lag. In short, places that retired nuclear and moved slowly on wires while leaning hard into offshore wind entered the data-center era underprepared, and are now struggling to keep up or raising rates to fund capacity and grid upgrades.

Frustration is spreading. In Missouri, Senator Josh Hawley has denounced “massive electricity hogs,” accusing Silicon Valley of pushing costly transmission projects that residential ratepayers subsidize. Georgia’s Public Service Commission race has revolved around claims that data-center operators enjoy five-cent kilowatt-hour rates while households pay four times more. These fights reflect an economic truth: fixed-rate industrial contracts and tax abatements merely shift costs onto consumers rather than reducing them.

Demand growth is not only remarkably strong, but rising and difficult to predict. The International Energy Agency expects global data-center power consumption to nearly double by 2030. But in a genuinely competitive market, such growth would attract private investment in new generation and transmission. Instead, multi-year permitting processes, domestic-content mandates, and litigation have throttled supply. Investor-owned utilities plan more than $1 trillion in capital projects through 2029 — much of it driven by regulation rather than market need — costs that inevitably flow into rate bases and monthly bills.

The political realignment around AI infrastructure reveals a deeper lesson: energy cannot be centrally planned without trade-offs. States like Texas, where competitive markets respond directly to price signals, deliver electricity at roughly half the price of Massachusetts and maintain stronger reliability despite rapid demand growth. By contrast, states that rely on administrative planning have locked in higher costs and slower innovation.

Average Retail Price of Residential Electricity, Massachusetts (blue) vs. Texas (white), 2015 – present

(Source: Bloomberg Finance, LP)

Both parties sense the stakes. The Trump administration’s AI Action Plan seeks to accelerate approvals and expand grid capacity to preserve US dominance over China, even as it moves to slow the retirement of fossil-fuel plants and roll back tax incentives for wind and solar. Democrats promoting the “abundance” agenda hail data centers as foundations of a digital and decarbonized future. Yet the economic tension is the same: who pays for the electrons that power the machines?

Electricity is no longer a neutral input; it is a commodity of both growth and grievance. The market could meet rising demand efficiently if freed to do so. Instead, bureaucratic control, subsidy races, and political favoritism have produced shortages that politics then exploits. The cure being offered — more mandates, more subsidies, more planning — is itself the disease.

A genuinely market-based approach would let prices reflect scarcity, open generation and retail supply to competition, and end cross-subsidies that hide costs from voters. Decarbonization and innovation can coexist with affordability, but only when capital is allowed to flow where returns justify the risks taken. As Americans open their power bills they are discovering, and in some cases rediscovering, that electricity is ultimately a market good, not a political entitlement, and that attempts to regulate away its costs only defer and magnify them.